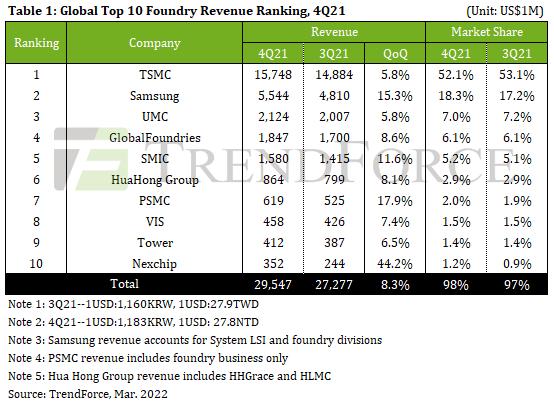

The output value of the world’s top 10 foundries in 4Q21 reached US$29.55 billion, or 8.3% growth QoQ, according to TrendForce’s research. This is due to the interaction of two major factors. One is limited growth in overall production capacity. At present, the shortage of certain components for TVs and laptops has eased but there are other peripheral materials derived from mature process such as PMIC, Wi-Fi, and MCU that are still in short supply, precipitating continued fully loaded foundry capacity. Second is rising average selling price (ASP). In the fourth quarter, more expensive wafers were produced in succession led by TSMC and foundries continued to adjust their product mix to increase ASP. In terms of changes in this quarter’s top 10 ranking, Nexchip overtook incumbent DB Hitek to clinch 10th place.

TrendForce believes that the output value of the world’s top ten foundries will maintain a growth trend in 1Q22 but appreciation in ASP will still be the primary driver of said growth. However, since there are fewer first quarter working days in the Greater China Area due to the Lunar New Year holiday and this is the time when some foundries schedule an annual maintenance period, 1Q22 growth rate will be down slightly compared to 4Q21.

Top 5 foundries account for nearly 90% of global market share, Samsung recovers share with advanced processes

Looking at the top five industry players, TSMC’s 4Q21 revenue reached US$15.75 billion, a QoQ increase of 5.8%. Although 5nm revenue spiked thanks to the new iPhone, 7/6nm revenue dropped due to a weak Chinese smartphone market, becoming the only TSMC node in decline in 4Q21, and inducing a contraction in TSMC revenue growth in 4Q21, though TSMC still accounts for more than 50% of global market share. As one of TSMC’s few competitors in advanced processes below 7nm, Samsung strengthened 4Q21 revenue to US$5.54 billion, a quarterly increase of 15.3% owing to the gradual completion of new advanced 5/4nm process capacity and the mass production of new flagship products from major client Qualcomm. Although Samsung’s foundry business has posted record revenue, the slower ramp-up of advanced process capacity continues to erode overall profitability. Therefore, TrendForce believes that improving advanced process capacity and yield in 1Q22 is one of Samsung’s top priorities.

Constrained by limited growth in new production capacity and the fact that the new wave of wafers contracted at the latest pricing has yet to be produced, UMC’s revenue stalled slightly in 4Q21, to US$2.12 billion, up 5.8% QoQ. GlobalFoundries benefited from the release of new production capacity, product mix optimization, and new long-term agreement (LTA) pricing, pushing up ASP performance. Revenue in 4Q22 hit US$1.85 billion, up 8.6% QoQ. SMIC posted 4Q21 revenue of US$1.58 billion, 11.6% QoQ, due to mounting demand for products such as HV, MCU, Ultra Low Power Logic, and Specialty Memory as well as factors such as product mix adjustment and appreciating ASP.

Surpassing DB Hitek, Nexchip officially breaks into the top 10 in 4Q21

The foundries ranked 6th to 9th are HuaHong Group, PSMC, Vanguard International Semiconductor (VIS), and Tower Semiconductor (Tower), respectively. Each has benefiting from factors such as a utilization rate uniformly at full capacity, release of new production capacity, and adjustment of ASP and product mix, sustaining the growth of revenue performance. It is worth mentioning, the acquisition of Tower by Intel netted Intel mature process technologies and a customer base and expanded the diversity and production capacity of its foundry business. However, before this transaction is officially completed, Tower is still considered an independent entity in terms of the accounting process. TrendForce states, after Intel’s foundry business is properly integrated with Tower, Intel will officially enter the ranking of top ten foundries.

Coming in 10th on the top 10 foundry ranking is Nexchip with revenue of US$352 million and a quarterly growth rate of 44.2%, the fastest growth rate among the top ten, and officially surpassed DB Hitek. According to TrendForce investigations, the primary reason Nexchip was able to break into the top 10 in 4Q21 was the company’s diligent production expansion. Nexchip also plans to develop more advanced processes such as the 55/40/28nm nodes and multiple product lines including TDDI, CIS, and MCU, to compensate for its current single product line and limited customer base. Since Nexchip is currently ramping-up operations quickly, its growth performance in 2022 should not be underestimated.