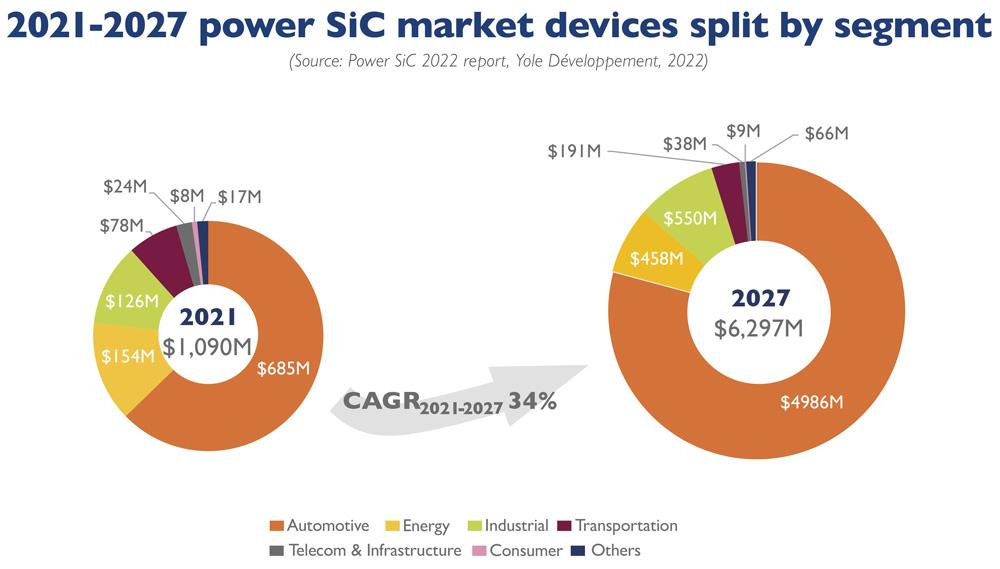

The global silicon carbide (SiC) device market is rising at a compound annual growth rate (CAGR) of 34% from $1.09bn in 2021 to $6.3bn by 2027, estimates market research and strategy consulting firm Yole Développement in its latest annual report ‘Power SiC 2022’.

“Strongly driven by automotive applications, especially in the electric vehicle (EV) main inverter, there were multiple newly released EVs and announcements in 2020 and 2021, following Tesla’s adoption of SiC,” says Poshun Chiu, technology & market analyst specializing in Compound Semiconductor & Emerging Substrates, at Yole. “Moreover, Tesla’s record shipments helped SiC devices to reach the order of $1bn in 2021,” he adds. “To fulfill the demand for a long driving range, an 800V EV is the solution to empower fast direct current (DC) charging. This is where the 1200V SiC devices play crucial roles.”

As of 2022, BYD’s Han-EV and Hyundai’s Ioniq-5 have enjoyed good sales by offering fast charging. More OEMs – such as Nio, XPeng, etc – plan to bring SiC EVs to the market in 2022.

Apart from automotive applications, industrial and energy applications – such as deployment of high-power charging infrastructure with SiC modules, and the growing installation of photovoltaics – represent markets with a growth rate of more than 20% during the forecast period.

Among the top SiC device players, STMicroelectronics and Wolfspeed grew their SiC revenue more than 50% year-on-year in 2021, aligning with the 57% growth in the global SiC device market. Infineon Technologies achieved 126% growth by entering the main inverter business, based on industrial applications. onsemi also entered the game, yielding strong growth in 2021.

As these companies grow SiC into billion-dollar businesses, competition in the coming years can also be identified in supply chain integration. The major players have chosen IDM business models, and multiple mergers and acquisitions (M&As) and partnerships in silicon carbide have reshaped the SiC ecosystem. They aim to secure their wafer supply and enter the device business to sustain their billion-dollar business objectives in the years to come, adds Yole.

The next level for players to compete in is the SiC module, and Yole has identified new products being released for automotive, industrial, and energy applications.